A policy can cost as little as $99 a month. And by purchasing a policy while children and grandchildren are young and in good health, parents and grandparents can help protect a lifetime of dreams at a minimal cost, while locking in insurability.

|

Parents and grandparents have the opportunity to leave a legacy to their children or grandchildren by providing one of the greatest gifts – life insurance. A policy can cost as little as $99 a month. And by purchasing a policy while children and grandchildren are young and in good health, parents and grandparents can help protect a lifetime of dreams at a minimal cost, while locking in insurability. Contact me today! 888-883-5290 | email Jeanine Kinzie is a Licensed Health Insurance Agent, Licensed Life Insurance Agent and a Federally Facilitated Marketplace Enroller / SHOP Marketplace Enroller from Grand Rapids, Michigan. Jeanine is licensed in MI, TX, IN, IL, WI, AZ, VA, AL, VA, & OH.

3 Comments

If you have purchased a term life insurance policy within the last 4 years and would like to make it a permanent policy, we can help you do this without having to go thru a new paramed exam. 98% of term policies do not pay out a claim. This is why it is so inexpensive. It serves a purpose in certain situations. Yet it is important to have a permanent solution. I have never heard anyone say their loved one left them too much life insurance. Jeanine can show you creative solutions which will benefit you greatly at not much cost. If you would like to discuss these options, contact Jeanine! Jeanine Kinzie is a Licensed Health Insurance Agent, Licensed Life Insurance Agent and a Federally Facilitated Marketplace Enroller from Grand Rapids, Michigan.

If this isn't you, give us a call. We would like to discuss your family's future with you and the many options available to you that you may not even be aware of.

Millions of Americans have made annuities and life insurance part of their retirement savings strategy. In most cases, both can provide a death benefit to the contract owner's named beneficiaries. But whom you name, and how you designate your beneficiaries, can have a dramatic impact on how much of your financial legacy they receive.

When you are considering an annuity or life insurance contract, you usually must determine who will inherit your contract's value or policy death benefit. Like many of us, you may simply say, "We just want to leave it to the kids (or the grandchildren)." Be sure, however, you are making an informed decision, one that will truly reflect your intentions. Here are some important suggestions to keep in mind.

The beneficiary choices and percentages that made perfect sense years ago can seem painfully out of date today. Just think of you own family. How much has it changed over the past 10 or 15 years? Don't you think it would be a good time to dust off any annuities or life insurance contracts you currently own -- and make sure your beneficiary choices are still up to date? We could list other examples that show the importance of carefully choosing beneficiaries and periodically reviewing those choices. But your family and your financial situation are unique. So be sure to bring up the topic the next time you speak with your family's financial professional, attorney, or tax advisor. Feel free to contact me for more information about choosing beneficiaries. The government has passed a law to require insurance companies to have a higher reserve for life insurance policies. Starting 1/1/13, the rates for all carriers will be going up to accommodate the new requirements. This is another reason to get your policy in place this year using your current para-med results which qualified you for the best rate possible.

Please reference my earlier blog post - AG 38 = Increased Reserves, Higher Premiums! Penn Mutual has released a new Indexed Universal Life insurance plan which includes 4 additional options for your investments inside the policy. It includes International funds which have had a higher average returns in the past 5 years than the S&P 500. It also has a 30 year minimum guarantee built-in, and includes the same living benefits for critical and chronic illness and lifetime retirement income. I believe this new type of coverage will be more beneficial to you than the current IUL you have quotes for. We can choose either type of plan before November 30 when the current version will be discontinued. I can run a quote for you if you'd like to see some numbers. AG 38 = INCREASED RESERVES!

You may not have heard that AG 38 (Actuarial Guideline 38 created in 2003 to clarify Valuation of Life Insurance Policies) will require life insurance companies to hold more reserves for products that contain a 'secondary guarantee' or a death benefit guarantee. These changes were adopted September 12, 2012 and will go into effect for new policies written after January 1, 2013. When they go into effect the Universal Life rates will increase! HIGHER PREMIUMS! RATES WILL GO UP. It is just a matter of how much. If you have any thoughts about life insurance, or if you are are 'on the fence' about converting your existing term policy, or buying new universal life policies - NOW IS THE TIME and the clock is ticking. In actual reality - there is probably about a 60 day window starting NOW. Life Insurance is more affordable now than ever. 85% of people overestimate the cost of life insurance and are surprised they can afford it so easily. Contact me to see how I can help provide peace of mind to those you love.

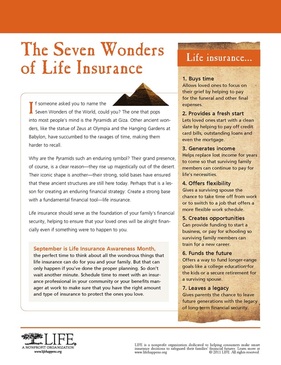

6. Funds the future

Offers a way to fund longer-range goals like a college education for the kids or a secure retirement for a surviving spouse. 7. Leaves a legacy Gives parents the chance to leave future generations with the legacy of long-term financial security. Contact Jeanine to find out about all the different options you have for life insurance. Insurance products change over time for various reasons. The window of opportunity to secure a solid policy closes on August 31st for a non-med simplified issue underwriting with competitive premiums, low face amounts, high issue ages, and a range of options and riders for your needs today. This portfolio offers protection, value and convenience with the strength of an "A" rated company. If you want to purchase life insurance on a loved one, this is one of the least obtrusive ways to secure coverage. Whether it be for student loans or to provide a legacy, this policy has optional riders for living benefits too.

Contact me for more details or a free no-obligation quote. Jeanine Kinzie Insurance Agent and Certified Advisor |

About Jeanine KinzieI love to work one-on-one with my clients to provide safe investment choices which will contribute to the financial success and security of individuals and families. ResourcesCategories

All

Archives

May 2015

|

RSS Feed

RSS Feed