|

The answer depends on when your policy was written. If your policy is PPACA compliant, meaning it was written for an effective date 1/1/14 or later, it will contain coverage for "Clinical Trials", as one of the Essential Heath Benefits. Clinical trials mean that medicine and treatments which have not yet received FDA approval but would substantially improve or extend the quality of ones health, can be covered by insurance. Naturally, it will be paid according to the terms of your policy. Ones life has to be in jeopardy for treatments to be covered. For example, treatment to grow hair is a clinical trial, but insurance probably won't cover it as it won't extend life. Hopefully you won't need clinical trials, but it is good to know they are available on the 2014 Affordable Care Act health insurance plans. Jeanine Kinzie is a Licensed Health Insurance Agent, Licensed Life Insurance Agent and a Federally Facilitated Marketplace Enroller / SHOP Marketplace Enroller from Grand Rapids, Michigan. Jeanine is licensed in MI, TX, IN, IL, WI, AZ, VA, AL, VA, & OH.

1 Comment

CLICK to DOWNLOAD this handy little guide to answer basic questions about PPACA Healthcare Reform from United Healthcare.

Please contact me for any questions not covered in the booklet. Health care reform requires that all individual and small group health plans offer these 10 essential benefits starting in January 2014. Many of the benefits weren't provided or fully covered in the past, so including them means more benefits with more protection for you. Ambulatory patient services - Care you receive without being admitted to a hospital - such as at a clinic, physician's office or same-day surgery center. Emergency services - Care for conditions which, if not immediately treated, could lead to serious disability or death. Hospitalization - Care you receive as a patient in a hospital, such as room and board, care from doctors and nurses, and tests and drugs administered during your stay. Maternity and newborn care - Care provided to women during pregnancy and during and after labor; care for newly born children. Mental health and substance abuse disorder services - Care to evaluate, diagnose and treat mental health and substance abuse issues. Prescription drug coverage - Drugs prescribed by a doctor to treat an acute illness, like an infection, or an ongoing condition, like high blood pressure. Rehabilitation and habilitation services and devices - Services and devices to help people with injuries, disabilities or chronic conditions gain or recover mental and physical skills. Laboratory services - Testing blood, tissues, etc., from a patient to help a doctor diagnose a medical condition and monitor the effectiveness of treatment. Preventive and wellness services and chronic disease management - These services include routine physicals, screening and immunizations. Chronic disease management is an integrated approach to manage an ongoing condition, like asthma or diabetes. Pediatric services - The other nine essential benefits are provided to children along with dental and vision care. Resources For Health Care Reform Updates - Websites To Check In With www.KFF.org www.AHIP.com www.HHS.gov www.CBO.gov www.NAIC.org www.statereforum.org/states www.ncpa.org Jeanine Kinzie is a Licensed Health Insurance Agent, Licensed Life Insurance Agent and a Federally Facilitated Marketplace Enroller from Grand Rapids, Michigan.

Under the new health care reform laws, there will be some changes coming in the way you pick, purchase and pay for your plan. Here are some of the upcoming steps and dates to remember: October 1 The Health Insurance Marketplace opens for business for coverage effective Jan. 1, 2014. It is optional for you to participate if you already have coverage. Most carriers are not forcing any changes to current coverage until 1/1/15 for individual plans. Group insurance benefits must upgrade to the new benefit requirements effective the renewal date next year. The enrollment form does not include health status with the exception of tobacco use. Plans will be more uniform since they must conform to Essential Health Benefits of the "metal" plans: Bronze (60%), Silver (70%), Gold (80%), Platinum (90%), and Catastrophic (available to those in certain situations, under age 30). We encourage you use our services for comparing your options an enrolling in a new plan if it is a better option for you. Open enrollment starts Oct. 1, 2013. We will be able to enroll you in a non-medically underwritten plan for 1/1/14. For the initial year only, open enrollment lasts from 10/1/13 to 3/31/14. Coverage begins wither 1/1/14, or the 1st of the following month (for next year only), to ensure no gap in coverage. If you do not purchase insurance, most will have to pay 1% of their adjusted gross income as a penalty. We can assist you in calculating your subsidy so you know what your net cost is anticipated to be. You have an option of having the insurance carrier receive monthly payments from the government, or you can get a refundable tax credit if you do not receive a monthly subsidy. In most cases, subsidies are not available for those with group insurance options. January 1 Tax credits (or subsidies) become available. Go to http://kff.org/interactive/subsidy-calculator/ and use theSubsidy Calculator Tool to see if you qualify. Be forewarned, there are a lot of moving parts to this and it's getting more complicated than ever. Your accountant may have recommendations for your situation due to income projections changing for 2014. Keep in mind that open enrollment ending means that you won't be able to purchase coverage anytime during the year, without a qualifying condition. A qualifying condition would be loss of group coverage due to job loss or change of family status (birth, divorce, adoption, marriage). The next open enrollment would be October 1st, 2014 for January 1, 2015 effective date. Jeanine Kinzie is a Licensed Health Insurance Agent, Licensed Life Insurance Agent and a Federally Facilitated Marketplace Enroller from Grand Rapids, Michigan.

How does the Patient Protection and Affordable Care Act (PPACA) affect people?

Since 2010, insured have enjoyed free wellness care, as long as it fits the guidelines set forth in PPACA. (See www.Heathcare.gov/prevention for details of the wellness treatments you are eligible for.) To ensure he didn’t have any concern for lung cancer, my friend, a former smoker, asked during his recent wellness visit for a chest x-ray and was denied. The doctor said it wasn’t necessary. His mother died of cancer at age 62. He is turning 57 this year and felt it was necessary for his peace of mind. He is willing to pay for it and couldn’t get the Doctor to order the x-ray. Only 1% of lung x-rays show cancer, but what if he is the 1%? The bigger picture is that behind the scenes, PPACA is changing Doctor’s compensation from a “fee for service” (where providers profit from providing more services) to “capitated” payments (where providers profit by providing fewer services) or some hybrid. Meet the new final authority for health care in America. It’s not Congress, not the Court, and not “We the People”. It’s an Independent Payment Advisory Board (IPAB), an unelected, unaccountable 15-member panel empowered to set healthcare standards for spending, care and efficiency that will affect all of us. It is quite possibly the most dangerous aspect of the entire PPACA law. IPAB is not required to hold any public hearings and its decisions are not subject to administrative or judicial review. It has the power to tax and ration care. This is all by design. The authors of Obamacare decided to take the difficult matters away from politicians. The “quality and efficiency” standards set by IPAB affect ALL health care, not just Medicare and Medicaid. This means your utilization of your private health insurance will be affected, even if you are willing and able to pay for treatment. There will be one standard of care for all. IPAB has determined too much money is spent in the last year of life. Furthermore, as IPAB is reducing compensation to Medicare/Medicaid providers, fewer Doctors can afford to continue serving this population. There is a silent exodus already in motion from Doctors. This movement is the beginning of rationed care. So how does PPACA affect you? It will depend on your age, wealth and health. *“Hidden Dangers of Obamacare” was used as a resource to this article. Jeanine Kinzie - Licensed Health and Life Insurance Agent If you would like to talk to an expert about what this means for your and how you can best protect yourself and your family in the future, Contact Jeanine! The Essential Health Benefits Package

Significant changes can be expected for many Americans in terms of the "Essential Health Benefits" plans. Significant changes can be expected for many Americans in terms of the "Essential Health Benefits" plans that will be offered when states begin implementing the public health care exchanges mandated by the Patient Protection and Affordable Care Act (PPACA) in less than one year. These changes are in addition to the benefit plan adjustments that already went into effect for new and existing insurance policies over the past year. Changes that already have been made include limits on pre-existing conditions, raising the cap on lifetime limits for essential benefits, limitations on when coverage can be rescinded, the age extension on coverage eligibility for children up to age 26 and coverage for preventive care - among other reforms. As agents, we are vigilant and track the impending mandates that will take effect. The good news is that there will be opportunities to standardize health care benefit offerings, but the bad news is that the PPACA-mandated changes will increase premium costs exponentially for many and disrupt existing insurance markets. Effective January 1, 2014, a health benefit plan offered through a state exchange will have to provide an Essential Health Benefits Package with limited cost sharing. (Section 1302 of PPACA): (A) Ambulatory patient services. (B) Emergency services. (C) Hospitalization. (D) Maternity and newborn care. (E) Mental health and substance use disorder services, including behavioral health treatment. (F) Prescription drugs. (G) Rehabilitative and habilitative services and devices. (H) Laboratory services. (I) Preventive and Wellness services and Chronic Disease Management. (J) Pediatric services, including oral and vision care. The cost-sharing under a health plan may not exceed the cost-sharing for high deductible health plans in 2014 (currently $5,950 individual/$11,900 family). In following years, the limitation on cost-sharing is indexed to the rate or average premium growth. Deductibles for plans in the small group market are limited to $2,000 individual/$4,000 family, indexed to average premium growth. This amount may be increased by the maximum amount of reimbursement available to an employee under a flexible spending arrangement. Levels of Coverage - PPACA defines specific levels of coverage to be offered by the state exchanges. A plan shall provide a level of coverage that is designed to provide benefits that are actuarially equivalent to a stated percent of the full actuarial value of the benefits provided under the benefit plan. They are:

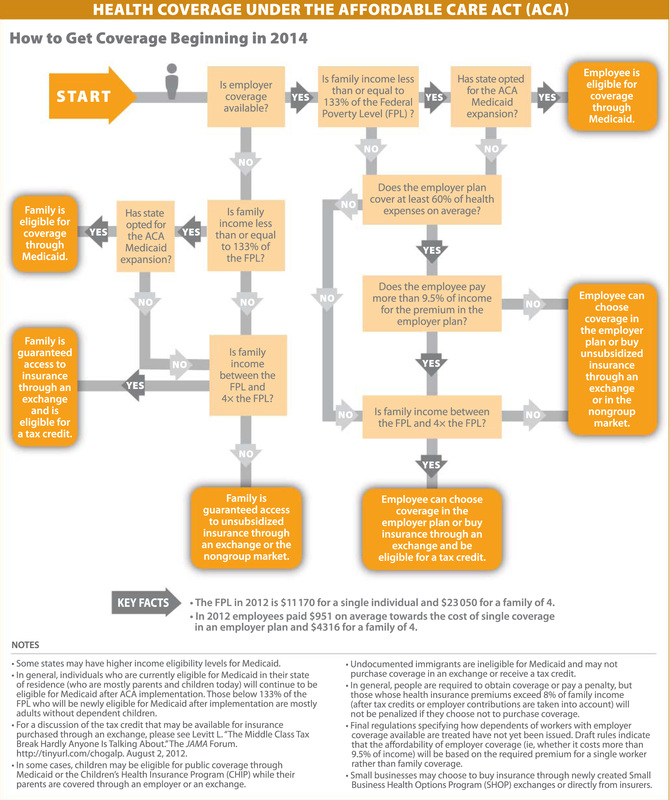

While January 1, 2014 appears to be relatively distant, it is too soon to know if you can keep your current health insurance plan. As citizens, we were promised, "If you like your plan, you can keep it." by President Obama during his campaign to pass the PPACA bill. Now it is unclear if that will be true. Perhaps, if the President's quote was "If you like your plan, too bad.", this bill would have never passed. The government fears adverse selection where healthy people quickly gravitate towards affordable medically underwritten plans in 2014 and stay on that plan post 2014. So, the peace of mind I'd like to offer, that you can stay on your current plan, won't be available until later this year. The answer may be quietly published amoungst the thousands of pages of regulations being rolled out monthly. Creative solutions are emerging to keep benefits affordable. Tell your uninsured friends and family to contact me for personal recommendations. Once medical underwriting goes away, rates will forever be higher. Grandfathered group plans are still available. As agents, we are committed to you, our valued clients, to offer solutions. If you have any questions, please contact me and I will be happy to assist you. Thank you for taking the time to read through this important notification. Contact Jeanine! Health Care Reform Takes Effect In 2014 What Does This Mean For You NOW? When the Affordable Care Act was introduced, it seemed like a good idea. Healthcare costs were escalating faster than inflation. People with pre-existing conditions found it difficult to get coverage. Preventative care wasn't used for early detection the way it was intended due to cost. 30 million people were uninsured and sometimes weren't able to cover the cost of their medical care. Something had to change. My opinion is and was that the changes required to fix the system didn't need a complete overhaul, but that's what we're getting. We have been led into the Patient Protection and Affordable Care Act of 2010 with the sweetness of free preventative care, children under age 26 allowed staying on their parent's plan, and no child under age 19 being declined for coverage. Next year, we won't have any medical underwriting so all policies will be guaranteed issue. Rate disparities between age bands will be reduced to a ratio of 5:1 to 3:1 which will result in significant rate increases for people in their 20's (not on their parent's plan). For policies beginning in 2014, PPACA compliant health insurance plans will be very expensive. New health insurance premiums will be very extensive and policies will cover much more than the average policy covers today. While you may be content with your coverage, more benefits always equal more premiums. A bigger increase will be applied to individual policies since group policies already cover more of the essential health benefits. (See details below on essential benefits.) Republican House Energy and Commerce Committee members, the Senate Finance Committee and the Senate HELP Committee issued a report looking at several previously released studies to make the point those premiums for Individuals and Small Groups are likely to spike in 2014 due to healthcare reform provisions. The reports I have received show a nationwide average increase for individuals purchasing new coverage next year to cost 50-116% more than this year. New group coverage is expected to cost 32% more than this year due to ramifications. We have creative solutions to reduce the increases implemented on current coverage. New product designs and supplements are being rolled out monthly. Yet rules for implementation are still forthcoming. The exchanges being put into place for purchasing insurance are expected to charge 30-50% more than purchasing insurance from an agent will cost. This is due to extra fees and taxes collected to help pay for the subsidy low income may receive when purchasing coverage thru the exchange. By the way, the proposed application for the subsidy is currently 45 pages long! The Internal Revenue Service is responsible for much of the financial eligibility after the application has been reviewed by Homeland Security. When we discuss your policy, I will advise you if you will be better served by the exchange than what I can assist you with. It's very complicated and I can't give too much general advice. Exchanges will open October 1st for January 1, 2014 effective dates. Many uninsured people are waiting to see what happens and what will be available to them. This may leave them with less affordable options. Please encourage your friends and family to talk to me about the affordable options NOW and can put in place today. If you have questions you'd like addressed, please email or call me. Contact Jeanine! Get Quotes Now Assurant Golden Rule/United Health One Hii More Information For more details, please visit www.uhc.com/united_for_reform_resource_center.htm, www.healthcare.gov, and www.kaiserhealthnews.org for more details. Click on the image to DOWNLOAD this infographic to see additional options for gaining coverage beginning 2014. Source: Keiser Family Foundation www.kff.org

|

About Jeanine KinzieI love to work one-on-one with my clients to provide safe investment choices which will contribute to the financial success and security of individuals and families. ResourcesCategories

All

Archives

May 2015

|

Great Lakes Insurance & Financial Services Blog

RSS Feed

RSS Feed